JANUARY 31, 2024 | BY MASTERCARD

At the beginning of June 2023, the full rollout of OVpay was completed at all public transport companies and in all Dutch regions. OVpay has enabled Dutch travelers to pay with their debit card, credit card or digital wallet in public transport.

Following the start of the rollout, the Netherlands has, since this summer, fully completed the launch of this nationwide contactless transit payment system, simplifying access and allowing travelers to tap-in and tap-out with a payment method of their choosing. All nine national and regional public transport providers across the country - including trains, buses, metros, and trams – joined forces and now all accept OVpay. OVpay entails an open loop system, consisting of upgraded infrastructure and innovative software, that ensures frictionless journeys throughout the country and secure payments.

Mastercard played an essential role in the launch of OVpay and the payment technology behind it. The company partnered with national and regional public transport companies to support local banks with implementing the necessary mobility transaction processes. MasterCard also served as a key advisor to Translink, the company behind all transactions in public transport in the Netherlands, ensuring that the necessary software updates and components were installed to move this country-wide transformation forward.

The simplified payment approach enhances navigation for transit users, which includes more than five million residents in addition to visitors to the Netherlands. Not only is it possible to pay with a debit and credit card, but riders can also pay with a smartphone or smartwatch (if their card is uploaded to their wallet). Prior to this development, people were only able to check in and out with a dedicated public transport pass or a ticket they bought for their ride. OVpay improves service benefits for both riders and tourists everyday as it increases efficiency, helps to reduce hold-ups, addresses environmental concerns, and increases accessibility.

With OVpay, tickets or public transport passes are no longer required, with the exception for those who have a subscription. That being said, for those with a public transport subscription, the benefits of OVpay are coming closer. Since September 2023, the GVB, the public transport provider in the Amsterdam region, made it possible for subscription holders to add a GVB-Flex subscription to their debit card, credit card or digital wallet. This means that travelers can continue to centralize their payments, and different cards for different purposes are becoming a thing of the past. This is a unique development for OVpay and an indication to other public transport providers that this is possible.

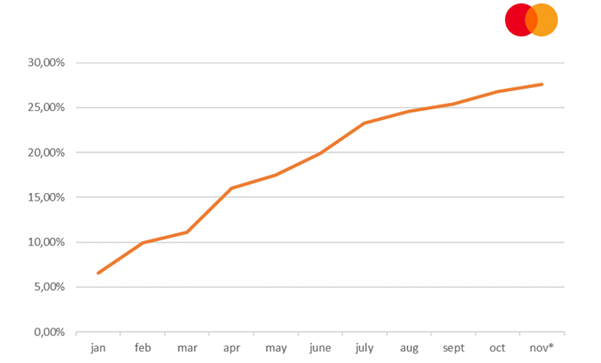

Since the rollout of OVpay earlier in 2023, the numbers prove that there was a great need for a system like this in the Netherlands. Where only 6,6% of all full rate payments were done with a debit, credit or online card in January 2023, in November 2023, this percentage already increased to 27,6%*. Especially during largescale events, such as King's Day or the Formula 1 weekend in Zandvoort, there was an increase in the number of people using OVpay in public transport.

Figure 1 Percentage of check-ins with debit card compared to OV-chip card based on full-fare payments.

“We’re more than proud to have supported the Netherlands in becoming the first country where checking in with your debit and credit card in public transport is possible nationwide. With this implementation, we are making public transport more accessible to the wider public,” says Jan-Willlem van der Schroot. “From now on, there is no need to separately buy tickets or miss your train because the balance on your public transport card is too low. It’s incredible to see how our efforts, and those of our partners, have made this happen.”

Open loop payment solutions are already accepted in metropolitan areas around the world, including London, New York City, Sydney, and Milan, but they have never been launched on a nationwide level before.

*Numbers are until November 18, 2023